Frederick Reichheld’s seminal article “The One Number You Need to Grow” noted that companies waste much time and resources attempting to measure customer satisfaction via complex surveys which suffer from poor response rates and ambiguous meaning. Building on pioneering work at Enterprise Rent-a-Car, the author found that a single “would recommend” question is a useful predictor of growth, focuses employees on the right corporate priorities, and captures true loyalty rates which clearly affects profitability (Reichheld, 2003).

Doing business today requires accountability for marketing performance tied to financial outcomes. Top executives, board members, and shareholders demand accountability for new and established marketing programs. Superior customer value means knowing customers’ behaviors and buying patterns. Metrics are an important part of the strategic marketing process to understand how successful the organization is now and what it needs to accomplish to become even more successful in the years ahead. Companies employ loyalty and retention initiatives which directly impacts business performance and maximizes long-term value for customers.

A major issue for debate in an organization is what metrics to collect and evaluate. The choices are wide-ranging -- from a single metric such as the Net Promoter Score (NPS) or North Star Metric (NSM) to literally hundreds of potential marketing and performance variables. For example, one leading book on the subject claims that there are 50 marketing metrics that matter related to the marketing mix, profit margins, customer profitability, share of market, the web, and other key areas in business (Faris et al., 2006). Clearly, a focused approach is best. Marketers should choose a limited number of strong industry-specific measures that make the most sense for an organization within the context of a relevant customer value metrics framework.

Measuring Customer Loyalty via the Net Promoter Score

There are many ways to evaluate customer loyalty such as customer satisfaction scores and indexes, repurchase intentions, recommendation intentions, etc. The NPS measure has capture the attention of marketing managers.

A single-item, 11 point-satisfaction scale -- the Net Promoter Score (NPS) – is used by Enterprise Rent-a-Car, JetBlue, Intuit (manufacturer of Turbo Tax software) and thousands of other companies. It is an easy-to-use and insightful metric to monitor business performance over time. Due to its simplicity and explanatory power, the Net Promoter Score (NPS) has been widely praised by marketing practitioners as the best metric for assessing customer loyalty and a company’s ability to grow.

A Net Promoter Score (NPS) is calculated as follows (Satmetrix, 2011).

1. Following the service experience, ask each customer one simple question:

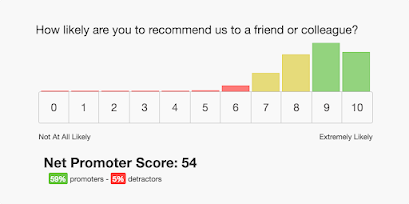

2. Based on your last experience with Company X, how likely would you be to recommend Company X to a friend or colleague? (Customers respond on a 0-10 point rating scale where 0 is not at all likely and 10 is extremely likely).

2. Respondents may be promoters (9-10), passives (7-8) or detractors (0-6).

T 3. The % of customers who are detractors is subtracted from the % of who are promoters (passives are not considered in the analysis) to compute your NPS.

Example: 78% of JetBlue customers are promoters, 12% are passives and 10% are detractors. Jet Blue’s NPS is 68. This is then compared to the competitive set. For example, Southwest Airline’s NPS is 62, Delta Airlines and the industry average is 38, and United Airlines is 10.

Mike Gowen, Co-founder of Delighted, says that NPS scores should be assessed absolutely and relatively. He suggests five ranges of customer experience: a negative number is poor performance, <30 = lots of opportunities for improvement, 31-50 = quality experiences are delivered, 51-70 = excellent customer experiences and 71+ is world class customer experiences. From a relative perspective, the software industry has an average NPS score of 41; a low score is 28 and TurboTax has a high score of 55 (Gowen, 2017).

Enhancing Your NPS Program

While the potential real-world advantages -- long-term value creation, customer loyalty, and corporate growth -- of a well-executed NPS initiative are clear, researchers are concerned that this single-item metric is subject to measurement bias, lacks validity, and may be inferior to other customer satisfaction and loyalty measures.

Here are three ways you can improve and adapt the NPS approach. First, the psychometric properties of the scale can be reevaluated. While an 11-point (0-10) point scale is intellectually appealing, consider using a 3-point (detractors, passives, or promoters) scale or the standard 5 or 7-point Likert scales. NPS research has been found to fare well on test-retest reliability -- a recent study reported an r =.75 which exceeded satisfaction with the brand r=. 70 and attitude toward the brand, r=.69 (Sauro, 2018). Further work is needed for other forms of reliability and validity.

Second,

the idea of the customer may be extended to other stakeholders such as

employees, suppliers, affiliates, and so forth. In response to management’s reliance

on NPS, United Airlines flight attendants pushed back by introducing a weekly

FPS (Flight Attendant Promoter Score) to evaluate management practices. The

early returns were not good as flight attendants gave airline management a

minus 95 week one (Murphy, Jr., 2022).

Third, employees in many industries are reported to be stressed from increased pressure to achieve excellent numbers. A more balanced view which would include NPS as part of a battery of key metrics is recommended. For further reading on customer value metrics, see blog posts 13, 18, 25, 36 & 38.

References

Farris, P.W, et al. (2006). Marketing Metrics: 50+ Metrics Every Executive Should Master, Upper Saddle River, NJ: Wharton School Publishing.

Gowen, M. (2017). What is a good Net Promoter Score to have? Response (May 19), www.quora.com/What-is-a-good-net-promoter-score-to-have/

Murphy, Jr. (2022). United Airlines flight attendants just made a big announcement and basically nobody is happy, Inc., August 6.

Reichheld (2003). The one number you need to grow, Harvard Business Review, December.

Satmetrix (2011). Calculate your Net Promoter Score, www.satmetrix.com/net-promoter/

Sauro, J. (2018). Measuring the reliability of the Net Promoter Score, Measuring the Reliability of the Net Promoter Score – MeasuringU

* Art Weinstein, Ph.D., is the blogmaster and a Professor of Marketing at Nova Southeastern University. He may be contacted at art@nova.edu